Reducing Risk and Strengthening Client Trust with DPO

Challenge

A global financial services provider deployed a generative AI assistant to streamline client queries and support compliance teams. While adoption was strong, the AI assistant struggled to balance clarity, regulatory precision, and usability. Over-refusals frustrated employees and clients by blocking valid queries, while vague responses created compliance risks when regulatory nuance was essential. The client needed a way to optimize outputs quickly for compliance, organizational tone, and client trust, without adding unnecessary overhead.

DDD’s Solution

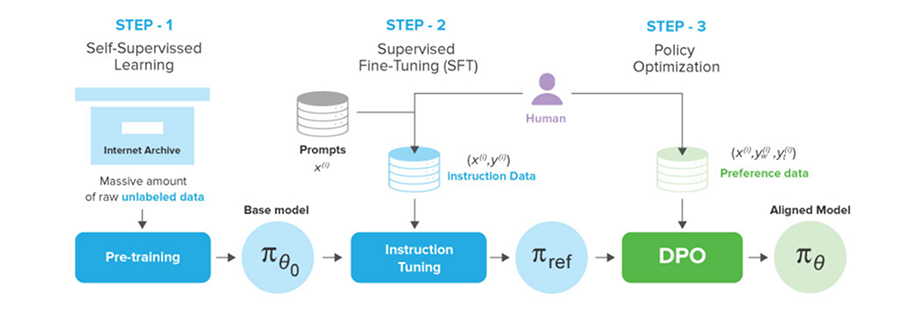

DDD implemented a Direct Preference Optimization (DPO) pipeline tailored to the financial domain. Compliance officers and financial analysts developed a custom rubric to evaluate responses on regulatory adherence, clarity, and tone. Thousands of ranked examples captured subtle differences between valid financial guidance, safe refusals, and policy-aligned disclaimers. The AI assistant was stress-tested with adversarial queries covering investment loopholes, disclosure boundaries, and cross-border regulations to ensure it could handle high-stakes situations reliably. By directly training on ranked human preferences, DPO enabled rapid optimization with fewer resources, making it well-suited for a fast-paced, regulated environment.

“Safe, Transparent, and Usable Financial AI with DPO”

Impact

Within three months, the optimized model achieved measurable improvements:

30% reduction in over-refusals, enabling smoother workflows and clearer responses for clients.

25% fewer compliance escalations, lowering regulatory risk exposure, and reducing review time.

Improved client trust, with higher satisfaction scores linked to clarity, transparency, and professionalism.

Operational efficiency, as compliance teams reported faster resolution times and greater confidence in AI-assisted outputs.